1850: The Midwest is part of Dixon's trilogy of games, which includes the most popular, 1870, as well as 1832. All three games share a similar ruleset. However, in following my practice on this site, what follows is written with the 1830 player in mind. For a complete rundown, you can download the current rulebook and see for yourself.

The good news is that the overall structure of 1850 is the same as 1830. The bank is the same ($12,000). The endgame conditions are the same (broken bank or bankrupt player). Capitalization is the same (full-cap at 60%). You do have semi-restrictive track placement, and of course you’ll want to review the privates and their special powers. Finally, there are a few quirks to the stock market (see below). However, the major differences boil down to the following rules:

- Price Protection, along with the related:

- Share Redemption &

- Share Reissuing

- Edge Tokens (a.k.a. “destinations”)

- Train Purchase Limits

The implications of all these differences creates a game that is still focused on the stock market, but without the same cutthroat speed of 1830. The train roster is longer, and it develops more slowly. You’ll want to pay attention to your train network and how you run your corporations moreso than in ’30; however, wielding the power of price protection is the new stock market manipulation tool worth your attention. I can’t even pretend to offer advice on its proper usage, but it should be fun!

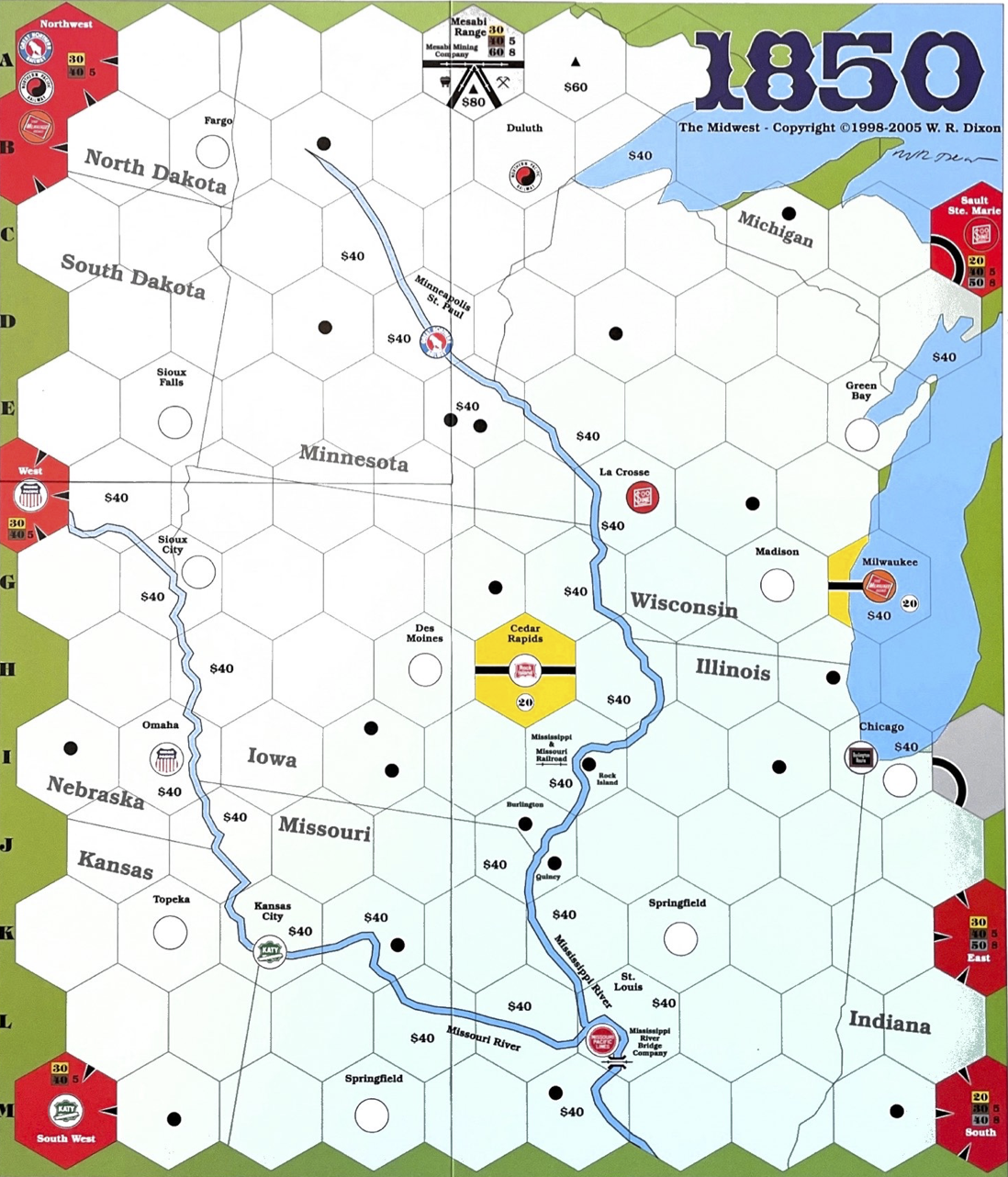

The Map

There are a couple tiles worth noting for their restrictions:

When laying a tile in Chicago, you can’t orient it such that future upgrades would be impossible.

The Mesabi Range costs a corporation $80 to run to or through (i.e., you’re purchasing the rights to travel through the hex). Purchasing the rights counts as your yellow tile lay. Only four corporations total may purchase the rights. And you can’t do so at all until the corresponding private company has been sold or closed.

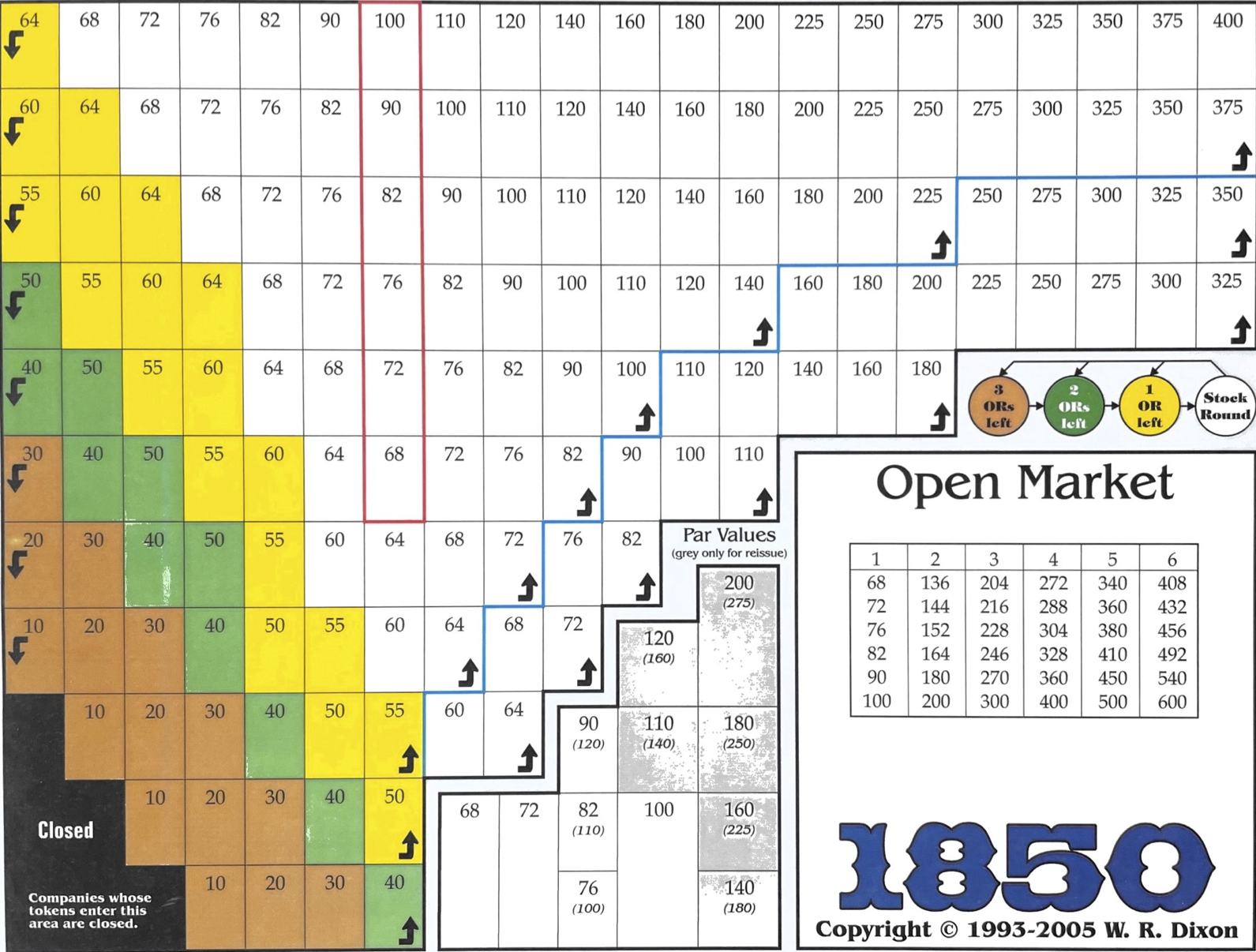

Stock Market

The new feature here to pay attention to is the blue line that snakes it’s way up and to the right. That blue line is the “soft ledge,” and it provides a bit of a buffer against stock trashing. When moving a token down after a stock sale, if the token is on the soft ledge and has exactly one space left to move, it instead stays on the soft ledge.

One other quirk of the 1850 stock market is that, whenever a token is at the top of the market and would otherwise go up (i.e., when all shares are in player hands at the end of a stock round), it instead moves one space down and to the right. This differs from 1830 where the token would simply stay put.

☞ A corporation that ends up in the black zone closes, losing all of its assets. When a corporation closes, it lowers the paper limit for all players.

Price Protection, etc.

First of all, unlike in ’30, shares in the IPO pay out to the corporation, while shares in the bank pool pay out to nobody. This is the reverse of how it works in ’30, but makes thematic sense otherwise, and so it isn’t too difficult to remember.

Protection

Second, price protection enables the president of a corporation to purchase a block of shares of his corporation that are being sold by another player. The sale happens at the stock’s current price, and, importantly, prevents the stock price from dropping. As a bonus, when using price protection, a president may purchase shares even when it would cause him to own more than 60% of the corporation (and he only has to sell back down to 60% if he later chooses to sell shares in that specific corporation). In other words, you can basically hang on to the extra shares as long as you like!

There are a couple of caveats. The president must purchase the shares immediately after the selling player finishes his stock turn, and he must purchase them as a block (all or none). Likewise, he may not sell other stock in order to raise funds for the purchase. Finally (and strangely), if a player invokes price protection during a stock round, the normal turn skips over to whoever is sitting to the left of the price-protecting player.

Redemption

As his sole purchase during a stock round turn, the president of a corporation may buy a matching share out of the bank pool (or from a player if that player agrees) at the current market price. He may only do this once per complete stock round. He uses corporation funds, and the corporation then owns the share (up to a maximum of 40%). Whenever the corporation pays out, the corporation gets the income from these redeemed shares.

Reissue

The flip side to redemption, share reissuing allows the president of a corporation to place all of his company’s redeemed shares back into the IPO for purchase by the players. He can only do this if there are currently zero shares in the IPO. Reissuing shares takes the entirety of the president’s normal stock turn.

Once shares have been reissued, their par price is set to the original par price or 75% of the current market price (rounded to the nearest available par price), whichever is higher.

Edge Tokens

In certain red off-board hexes there are corporation symbols. If the corresponding corporation places a token in its off-board hex, it can then include that hex in its route for double value.

☞ The token costs $50 to place. When running trains, this extra token cannot be the only token in the corporation’s route.

Train Purchase Limits

This one is easy enough: each corporation may only purchase a single new train from the bank per turn.

☞ A similar limit does not exist when purchasing trains from other corporations.

Other Odds and Ends

First Turn Track Placement

During a corporation’s first operating round, it may lay two yellow tiles.

Payouts

As an extra option when running a route, a president may elect to pay out half dividends. This means the corporation retains half the money, and the other half is divided amongst the shareholders. When doing so, the corporation’s stock price remains the same.